2020 is the final year of the 13th Five-Year Plan, and it is also a very tortuous year. At the beginning of the year, under the influence of the COVID-19 epidemic, many industries have stalled. With the concerted efforts of the people across the country, the economy has begun to recover, and future-oriented renewable energy has also returned to the fast lane of rapid development.

As of the end of October 2020, China’s cumulative installed capacity of photovoltaics has exceeded 230GW, and it is expected that this year’s new installed capacity will be 35GW, an increase of approximately 14% compared to 30.1GW in 2019. Behind the contrarian growth, China’s photovoltaic industry is also quietly ushering in changes.

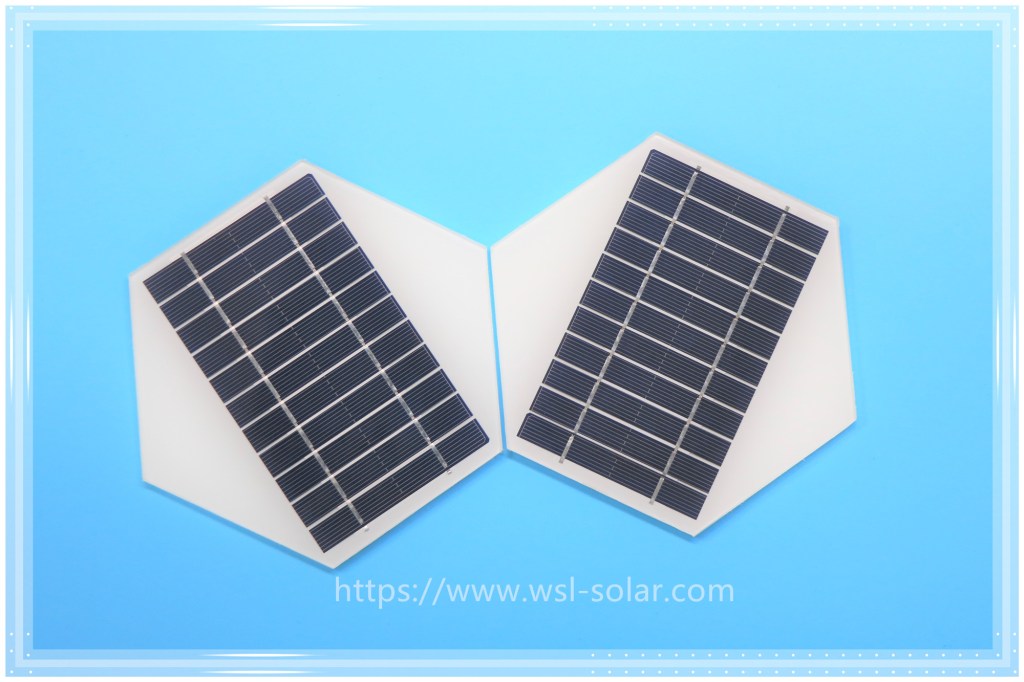

WSL Solar – Quality Custom Solar Panel Manufacturer

New installed capacity grows against the trend

Since the peak of 53.06GW in 2017, China’s newly installed photovoltaic capacity has been declining in the past two years. Especially from 2018 to 2019, the decline has exceeded 30%, making companies and investors more inclined to the development of photovoltaic industry Yu conservative.

However, in 2020, when photovoltaics are not optimistic, the estimated new installed capacity will increase by about 5GW compared to 2019, which exceeds market expectations and paves the way for the re-emergence of the photovoltaic industry. With the continuous decline of module prices, photovoltaics have also entered the protagonist stage with independent vitality from the stage of subsidy profitability.

Specifically, in 2020, distributed photovoltaics will usher in an outbreak. According to data released by the National Energy Administration, China’s newly installed distributed photovoltaic installations in the first November of this year have exceeded 10GW. In addition to the December installation data, it is expected to be 12GW. About one-third of the annual new installed capacity.

Recently, many cities in China have issued subsidy policies for household photovoltaics for up to 5 years. This move will stimulate further growth in the installed capacity of distributed photovoltaics, allowing photovoltaics to truly enter thousands of households and accelerate

photovoltaics to become the ultimate goal of conventional energy.

The market value of photovoltaic companies has skyrocketed

In November 2020, the share prices of Chinese new energy car companies rose sharply, BYD’s market value surpassed Volkswagen, and Weilai Automobile’s market value surpassed BMW. In fact, photovoltaic companies that have received less attention from the outside world have performed equally well.

On July 24, the market value of Longji, a leading photovoltaic company in China, exceeded 200 billion, on October 9 it exceeded 300 billion, and on December 23 it exceeded 350 billion, making it the highest photovoltaic company ever. The stock price also rose from 24 yuan at the beginning of the year to around 93 yuan. The market value of Tongwei shares in second place also officially exceeded 100 billion on July 21.

In addition to component companies, the market value of the supporting supplier Sungrow exceeded 100 billion on December 23, becoming the first inverter company with a market value of over 100 billion.

This situation may make the outside world puzzled, but the internal logic is also very simple, that is, revenue has risen sharply. In addition to the three companies mentioned above, the revenue of most photovoltaic companies in the first three quarters of this year has approached or even exceeded the revenue of the entire year of 2019. The performance is very eye-catching. It is not surprising that the stock price and market value have soared.

The battle for leading companies

In the past ten years, the technical routes taken by Chinese photovoltaic companies have not been consistent, and the differences in market layout have made it difficult for them to form an absolute advantage, and the module shipment champion has changed several times.

In 2011, China’s photovoltaic enterprise module shipment champion was Wuxi Suntech, 2012-2013 Yingli Group, 2014-2015 Trina Solar, 2016-2019 JinkoSolar won the module shipment champion for four consecutive years , Its position is not stable.

By 2020, according to JinkoSolar’s CEO, Mr. Kangping Chen, when he released the third quarter financial report, JinkoSolar’s total solar module shipments in 2020 will be in the range of 18.5GW to 19GW. Although there is more than 30% improvement compared to 2019, it is very likely to give up the championship position this year.

Longi announced in early December that this year’s module shipments have exceeded 20GW, exceeding JinkoSolar’s estimated total shipments, and annual shipments will be higher than 20GW. It is worth mentioning that LONGi’s module shipments in 2019 were only 9.0GW, and shipments in 2020 will increase by at least 120%.

This is inseparable from the high emphasis on technology. A few years ago, LONGi was positioned to develop monocrystalline cells. In 2017, its monocrystalline PERC cell conversion efficiency reached 23.26%, which was the industry’s leading level at that time. Since then, LONGi has made persistent efforts to increase the front conversion efficiency of single crystal double-sided PERC cells to 24.06% in early 2019, setting a world record.

This makes LONGi modules so popular in the market that they have achieved the surge in module shipments today. According to the calculation of the production capacity currently under construction and planning of LONGi, LONGi’s module shipment volume is expected to exceed 30GW in 2021 and continue to maintain rapid growth.

The price of photovoltaic glass unexpectedly soared

With the efforts of photovoltaic companies, the price of photovoltaic modules has shown a downward trend year by year. However, this year due to the epidemic caused some factories to stop production, and the hidden danger of insufficient photovoltaic glass production capacity already exists. The high demand in the second half of the year, coupled with capacity restrictions, further aggravated the shortage of photovoltaic glass.

According to statistics, the average price of mainstream coated 3.2mm photovoltaic glass has risen from 26 yuan/m2 at the end of July to the current 43 yuan/m2, a full increase of 65%, which has caused serious damage to the photovoltaic industry. However, there is also another scene, that is, many companies announced their entry into photovoltaic glass, including Kibing Group, CLP Rainbow and other glass giants.

Based on the 18-month investment and construction cycle of photovoltaic glass, it is necessary to wait at least until the end of 2021 to solve the shortage of photovoltaic glass in China. At that time, the pattern of existing photovoltaic glass companies will also have an impact. Whether existing giants use scale production to maintain their advantages or reshuffle between giants is a major highlight of the photovoltaic glass industry in 2021.

Frequent huge long-term contracts

Troubled by the shortage of photovoltaic glass, major module companies are paying more and more attention to the supply of raw materials, and huge long-term contracts are frequently issued at the end of the year.

In August, Longi signed a polysilicon procurement contract with Asia Silicon Industry for an estimated amount of about 9.498 billion yuan. In December, its seven subsidiaries signed a contract with Xinte Energy for 5 years, and there was a lot of cooperation. In the 270,000 tons of polysilicon material contract, more than 20 billion will be spent in half a year.

In November, Trina Solar signed long-term contracts with Hongyuan New Materials, Changzhou Almaden and other companies with an estimated amount of over 24 billion yuan, covering monocrystalline silicon wafers, photovoltaic glass and polycrystalline silicon materials. Raw materials, silicon rods and slicing projects are also involved.

This move has benefited a lot from Asian Silicon Industry, Tongwei and other raw material companies. It has also stepped out of a dark horse, that is, CNC. This advanced machinery manufacturing and information technology company with a revenue of less than 1 billion for many years Hongyuan New Materials, a subsidiary of the company, signed a huge contract with a leading photovoltaic company, and its share price has risen six times in the past year. This situation has also attracted a large number of companies to set up subsidiaries to enter the photovoltaic industry, but I don’t know if they can replicate the success of CNC.

Write at the end

2020 will be full of challenges for the global economy and major industries, and the photovoltaic industry is not immune. Fortunately, the photovoltaic industry has withstood the test. Not only has China’s new photovoltaic installations resumed positive growth, but many other countries and regions have also returned to the right track in the second half of the year. With the global emphasis on renewable energy and the efforts of photovoltaic people, photovoltaics are bound to usher in greater development in the future and at the same time make greater contributions to the realization of global carbon neutrality.

Posted by Carrie Wong | WSL Solar

WSL Solar has been a quality and professional manufacturer of custom solar panel and solar solution provider in China since 2006.

https://www.wsl-solar.com

Original news from https://www.wsl-solar.com/Industry_News/2021/0107/The-Photovoltaic-Industry-in-2020.html