How laser cutting machine works to cut solar cells into small pieces according to your solar panel design?

Cutting solar cells into small pieces is a critical process in solar panel manufacturing, especially for high-efficiency custom solar panels with specific designs. Here’s a detailed breakdown of how laser cutting works for solar cells.

The Core Principle: Controlled-Fracture Cleaving (for Monocrystalline Cells)

The most common method doesn’t “burn” through the silicon like a traditional laser cutter might with metal. Instead, it uses a highly focused, low-power laser to create a controlled thermal stress that induces a perfectly clean split along the crystal lattice. This is known as “laser scribing and cleaving” or “laser thermal separation.”

Step-by-Step Process

1. Design & Programming

- Your solar panel design is translated into a cutting path by CAD/CAM software.

- The software accounts for the wafer’s thickness, material properties, and the required edge quality to minimize electrical losses.

2. Laser Scribing (The Key Step)

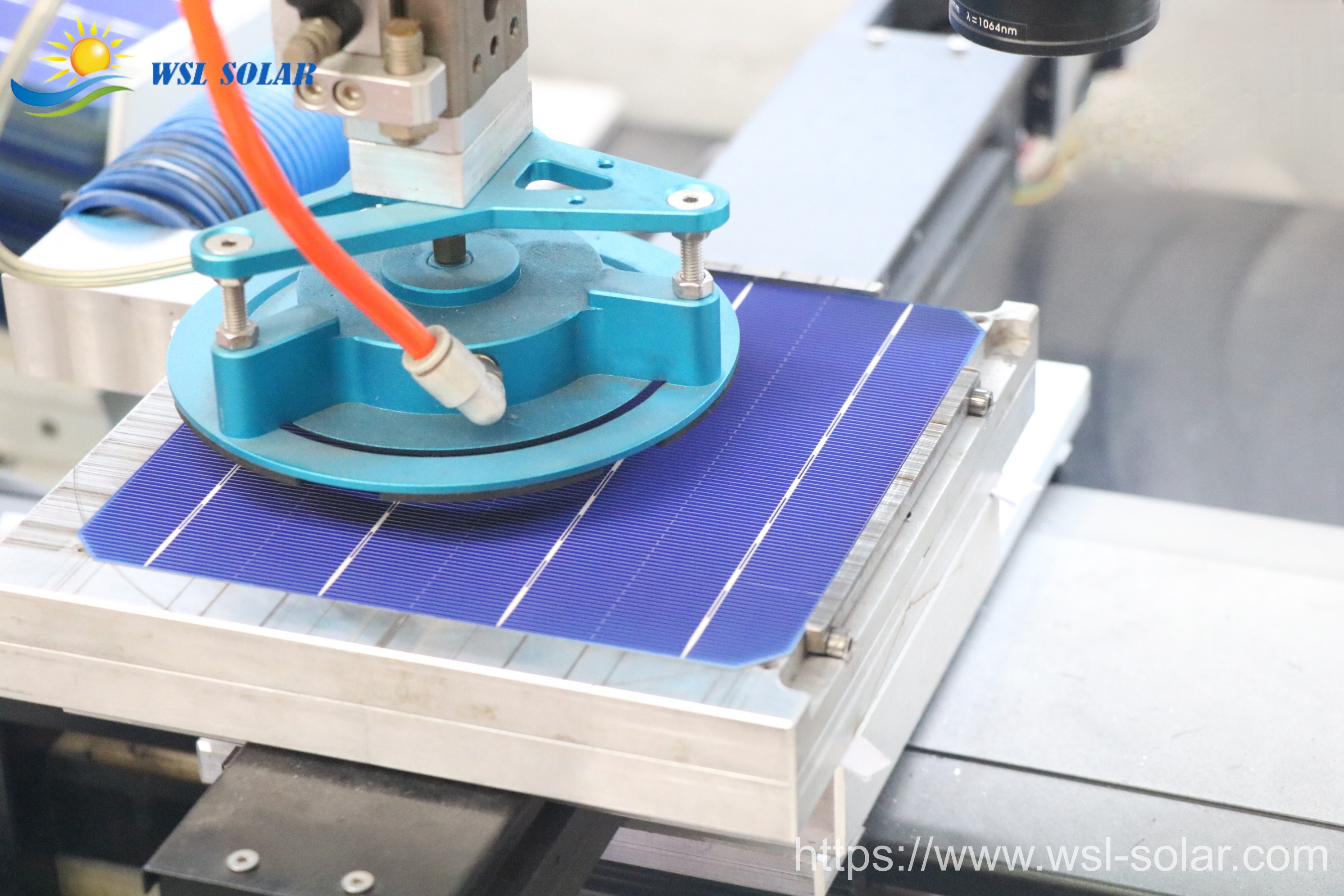

- A short-pulse, low-power infrared (IR) laser is focused to an extremely fine spot on the surface of the silicon wafer.

- The laser rapidly heats a tiny, localized volume of silicon (to over 1000°C) along the desired cut line.

- This creates micro-cracks or modifies the material structure along a precise, shallow path (the “scribe line”). The depth is carefully controlled – typically only 10-30% of the wafer’s thickness.

- Crucially, the laser does NOT vaporize the material. It creates internal stress and a weakened zone.

3. Cleaving / Breaking

- After scribing, a mechanical breaking step is often used.

- A controlled bending force applies pressure along the scribe line.

- Due to the induced stress and the guided micro-cracks, the silicon wafer fractures perfectly along the laser-defined path, following its crystalline structure.

- This results in a clean, smooth edge with minimal micro-cracks and no thermal damage zone (HAZ) that would reduce cell efficiency.

Why Laser Cutting is Superior for Solar Cells (Compared to Mechanical Saws)

| Feature | Laser Scribing & Cleaving | Mechanical Diamond Saw/Scribing |

|---|---|---|

| Material Loss (Kerf) | Minimal (only the laser scribe line). Saves expensive silicon. | Significant (the width of the diamond blade). Wastes material. |

| Edge Quality | Very clean, smooth, low micro-crack depth. Higher mechanical strength. | Rougher, more micro-cracks, weaker edges prone to chipping. |

| Precision & Flexibility | Extremely high. Can cut complex shapes, curves, and very small shingles easily. | Low flexibility, typically only straight lines. |

| Throughput & Speed | Very high speed (meters per second). Non-contact process. | Slower, mechanical wear on blades. |

| Dust & Contamination | Almost none for the scribing step. Clean process. | Generates silicon slurry/dust that must be cleaned, causing contamination. |

| Thin Wafer Handling | Excellent. The only viable method for wafers <150μm thick without breakage. | High breakage rates on very thin wafers. |

Critical Requirements for the Laser Process

- Ultra-Precision: Cutting must be accurate to within microns to ensure cells are identical for automated stringing.

- Minimal Heat Affected Zone (HAZ): The laser must not overheat the silicon, as heat creates defects that trap electrons, killing cell efficiency.

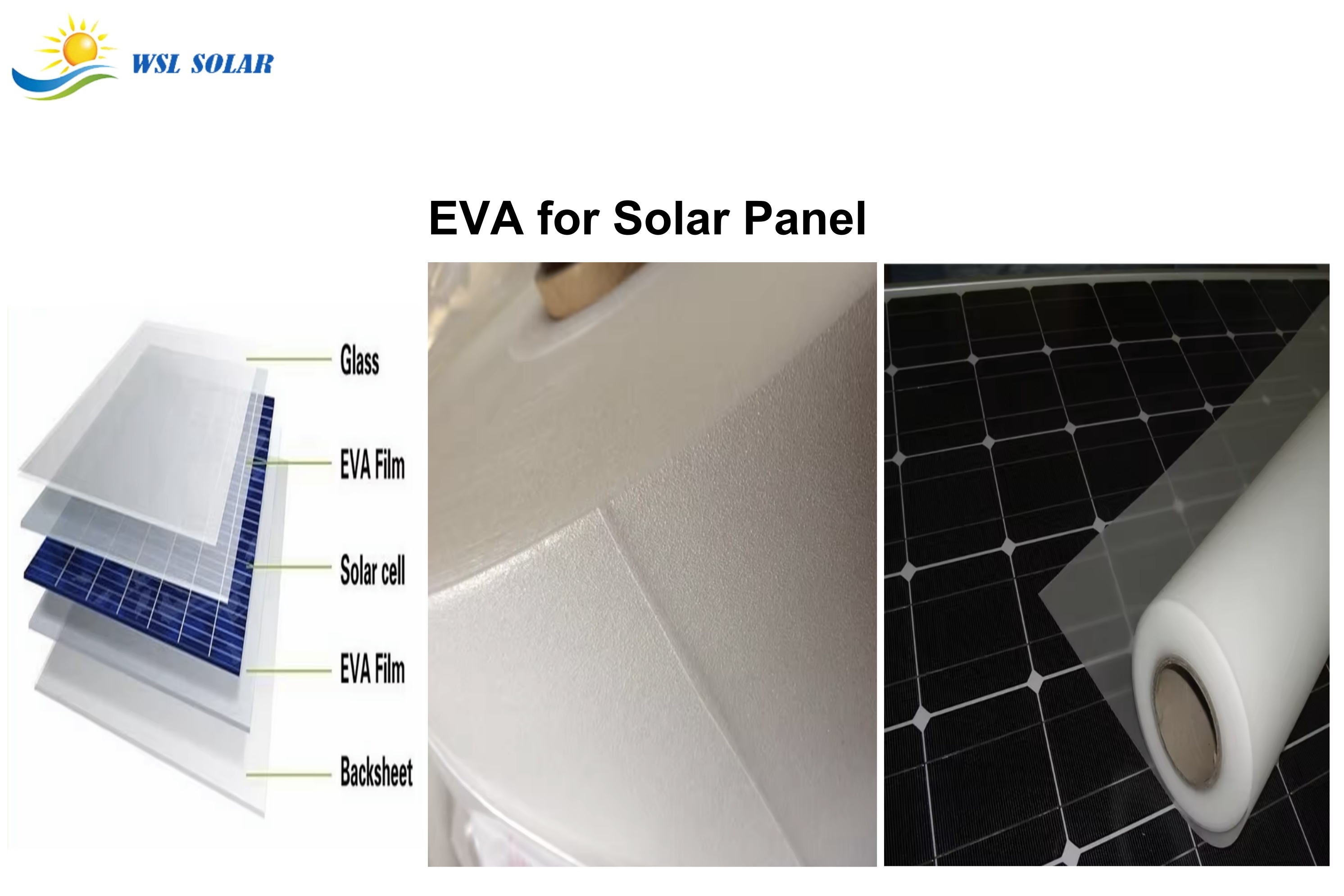

- Strength Preservation: The cut edge must remain strong to survive the subsequent manufacturing processes (transport, stringing, lamination).

Summary

In essence, a solar cell laser cutting machine uses a low-power, focused laser to “guide” a fracture through the crystalline silicon, rather than melting its way through. This cold-cutting process maximizes material yield, preserves the electrical quality of the silicon, and enables the intricate cell designs needed for today’s high-efficiency, high-power solar panels. It is an enabling technology for the continuous improvement in solar panel performance and cost-effectiveness.

Posted by Carrie Wong / WSL Solar

WSL Solar has been a quality and professional manufacturer of custom solar panels, solar mini panels, IoT solar panels and solar solution provider in China since 2006.

https://www.wsl-solar.com

Source of origin: https://www.wsl-solar.com/Industry_News/2025/1217/how-solar-cell-laser-cutting-machine-wor.html